How should advisors process the rapid rise of prediction markets?

City Wire RIA | Alec Rich | November 20th, 2025

Citywire spoke with a range of individuals across the wealth space and elsewhere to get a sense of the pros and cons of prediction markets as retail investors flock to the practice through brokerages like Robinhood.

As the government shutdown dragged on in recent weeks before reaching its 43-day conclusion, Sam Huszczo, founder of $454m Detroit-area RIA SGH Wealth Management, sensed that a few of his clients were feeling uneasy.

Not wanting to take a wild guess himself as to how long the shutdown might go, he instead turned to an unexpected tool to temper their expectations: prediction markets.

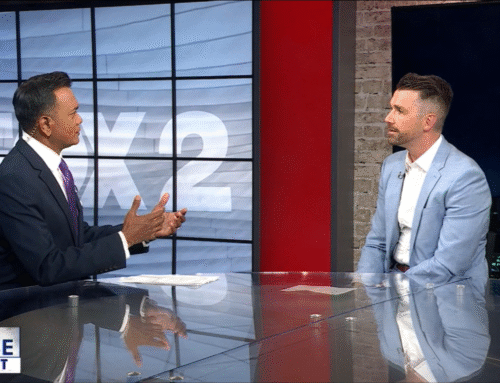

‘People speak with their money more than anything else,’ Huszczo said. ‘The element I like about it is there’s skin in the game for these predictions, whereas even talking heads on TV, there’s really no ramifications for them just making bold predictions.’

Prediction markets, which have skyrocketed in popularity over the last year, center around events contracts — a type of derivative usually structured as a binary yes-or-no question. The customer chooses what they think will be the outcome of a future event, then receives a payout if they are correct. These events can span a wide range of topics from the outcome of a football game to the results of a presidential election.

Keep In Touch