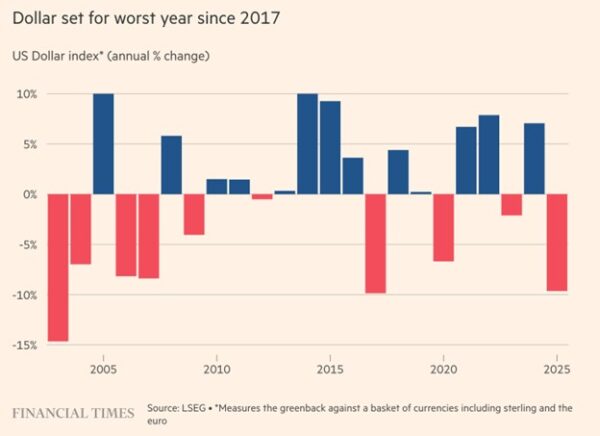

By the most common measure against a basket of global peers, the dollar slid over (-8%) in the past year, marking its worst annual drop since 2017. A dent that won’t come out with simple buffing or paintless repair. But to be clear, we are not turning into Zimbabwe overnight. Evidence of this can be found in the World Reserve currency allocations: with the US dollar still dominating at roughly 57% of global FX reserves.

Analysts are penciling in more dollar weakness, though FX predictions are voodoo with spreadsheets. The most likely scenario to come true is that bond rates will continue to fall, as the new Fed chairperson takes office midyear and follows instructions from the Oval Office to lower rates quickly. But, if everybody prints money did anybody print money?

Keep In Touch