4 Financial Mistakes to Avoid When Changing Jobs

SGH Wealth Management

Don’t forget about the Old 401k

Don’t forget about the Old 401k

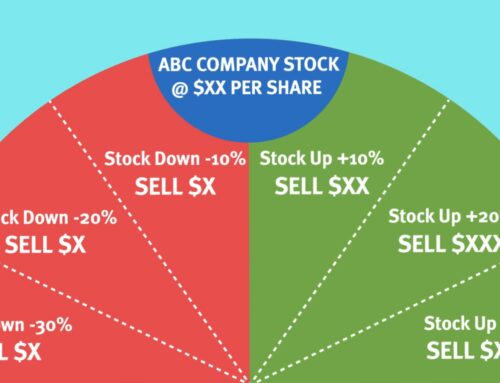

- Before doing anything make sure to explore all the pros/cons which includes: Fees, investment options, estate planning, NUA, Rule of Age 55, control, among more. And keep in mind that fees for small 401(k) plans (those with fewer than $10 million in assets) can run 1.19% to 1.95% in fees, according to analysis by America’s Best 401k.

- Thoroughly Analyze how to take advantage of your NEW Employer’s Benefits

- Whether it is putting together an asset allocation for the NEW 401k investment options or assessing more complex benefits like: RSUs, ESOPs, or Company Stock; Make sure that upon arriving at the new company that you are taking advantage of the benefits available to their max.

- Updating and Refining your Financial Plan

- This fork in the road should mean adjustments to your saving levels and could alter your retirement outlook all together. Adjusting your financial plan early on is critical in keeping you on track for a smooth runway to retirement.

- This fork in the road should mean adjustments to your saving levels and could alter your retirement outlook all together. Adjusting your financial plan early on is critical in keeping you on track for a smooth runway to retirement.

- This Calendar Year may have its Tax Opportunities

- Your job change will probably come with changes to your tax situation for this calendar year. This could possibly open the door for planning opportunities in: Roth Conversions, Advanced Roth Contribution Strategies, and more…

Keep In Touch