Make this The Year you get on a Financial Plan

SGH Wealth Management

In the history of todo lists, maintaining a written financial plan is a task that can easily get pushed off year to year. While juggling everything else in life, make sure to take time to set priorities for your future financial independence with a long enough runway to do so.

In the history of todo lists, maintaining a written financial plan is a task that can easily get pushed off year to year. While juggling everything else in life, make sure to take time to set priorities for your future financial independence with a long enough runway to do so.

Many polls have found that the number one regret of retirees is not having started their retirement transition plans sooner. With tax planning, real estate, employer stock, pensions and more; it’s no wonder why one could benefit from having a few more tax calendar years to insure that their assets are being used in the most efficient way. In addition, being on a plan gives the investor a greater sense of security and less anxiety centered around retirement.

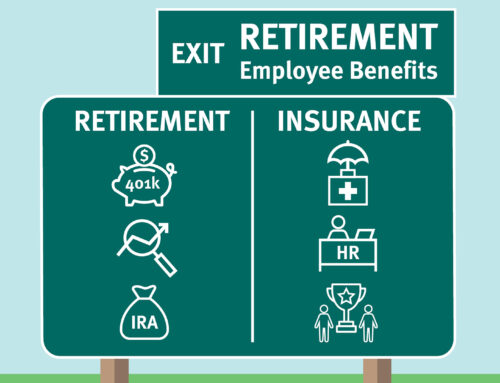

The beginning of the year is also high time to make sure you are fully taking advantage of all your company’s benefits and pushing the envelope on increasing your automated monthly savings.

The beginning of the year is also high time to make sure you are fully taking advantage of all your company’s benefits and pushing the envelope on increasing your automated monthly savings.

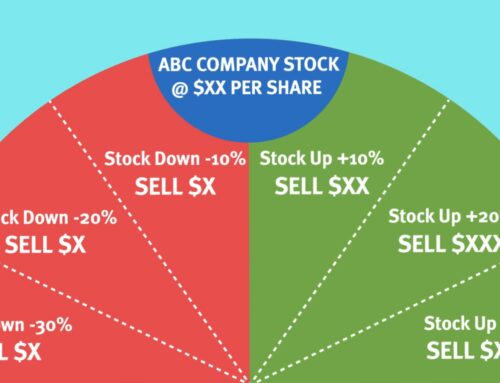

On the investment side, buying stocks is easy while selling has proved to be much more psychologically difficult, for even the savviest do-it-yourself investor. The ability to change strategies when warranted can be difficult and the start of year is a great opportunity to explore other possible strategies.

Ready to take the next step on the road to retirement? Let’s start a plan together and help you analyze your employer benefits to help you avoid the retiree’s number one regret in retirement with a SGH zero commitment Initial Consultation today!

Keep In Touch