Fees vs Commissions: What’s the Difference?

SGH Wealth Management

When choosing your financial advisor, it can be hard to make the selection an apples-to-apples comparison. Not only do advisors differ by empathy and competence, but also on fee structure. Knowing the differences between Fee Only and Commission advisors is an important step towards making the best decision on how your wealth will be managed.

The Commission Advisor (& Hybrid Advisor)

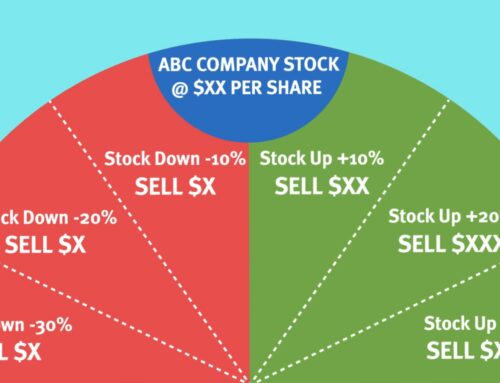

Commission advisors get their compensation directly from the products they invest you in. In not paying the advisor directly, the investor never knows the exact amount they are being charge as this is not seen on your monthly statements. Making it impossible for the client to do a true cost-to-benefit analysis. A common example of this today is seen in a mutual fund’s 12b-1 fee, designed to financially incentivize intermediaries for selling more of their product. Naturally raising the question of who’s best interest is this advice really in?

The Fee Only Advisor

The Fee Only Advisor

Fee only advisors charge a clear fee to their clients for advice without investment product incentives, similar to a lawyer. This fee can vary in structure and amount but is transparent and a line item in your monthly statements. There are three fee structures that fee only advisors can use: a flat annualized fee, an hourly rate, and a percentage of assets under management (AUM).

And ALWAYS get 3rd party verification of your potential advisor’s fee structure through the SEC’s: www.brokercheck.org.

Keep In Touch