A Reason to Celebrate your Age 59½ Half Birthday

SGH Wealth Management

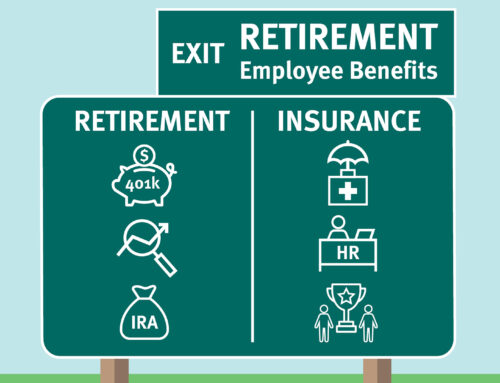

Not a milestone in most people’s books, age 59½ does come with perks that not everyone is aware of. Due to cost and simplicity-sake, many company 401ks limit their available investment options but given the complexities of today’s markets your portfolio may benefit from expanding those investment options further. At this age range, your return on investment could be the largest contributing factor in building your net worth, larger than the future contributions left until you retire. And the great thing is that an IRA rollover shouldn’t even impact your future contributions to your company’s 401k plan.

Who does this apply to?

- Only for those age 59½ and older and still working. Younger than this and you are stuck with your company-controlled investments options.

- This applies to 401(k)s, 403(b)s, 457s and Pensions as well.

- Tax-Free Rollovers should be rolled into an IRA account, otherwise this could be taxed and penalized.

Why Do It?

Expand your Investment Options: Due to the limited investment options that employer-sponsored plans generally offer, a move to an IRA could help better diversify your assets and give you the tools necessary to cater your portfolio to your custom investment needs.

Expand your Investment Options: Due to the limited investment options that employer-sponsored plans generally offer, a move to an IRA could help better diversify your assets and give you the tools necessary to cater your portfolio to your custom investment needs.

- Charles Schwab offers hundreds of thousands of different investment choices among them: Stocks, ETFs, Options, Futures, Bonds, Money Market Funds and may even offer the same Mutual Funds in your 401k

- Greater Control: IRA stands for Individual Retirement Account, meaning you are the direct account owner. This unshackles your assets from restrictions that your employer can impose on the 401k now or in the future.

Why Not?

- Rule of 55: IRS Rule of 55 allows an employee who is laid off, fired, or who quits a job between the ages of 55 and 59 1/2 to take money from their 401(k) or 403(b) plan without the 10% penalty for early withdrawal.

- Net Unrealized Appreciation: If you have a highly concentrated company stock position in your 401k it may make sense to leave it in the plan. The IRS offers a provision that allows for a more favorable capital gains tax rate on the NUA of employer stock upon distribution not available in IRAs. (qualifying events required)

- Cost: You are probably paying internal fees in your current 401k investment options. Always compare those fees to what you would be charged in a Rollover IRA.

*Always consult a tax professional before processing 401k rollovers. Restrictions, penalties, and taxes may apply.

Keep In Touch