Latest Blow to 60/40 Model Is Exodus of Mom and Pop Pensions

Ruth Carson & Claire Ballentine | Bloomberg | June 16th, 2020

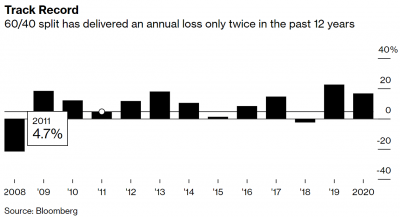

It’s a bitter pill for those who followed the “balanced” mutual fund mantra that was gospel in the investment industry. Even though the 60/40 strategy has produced gains of 7% this year in the U.S., financial advisers say many pension-saver clients are abandoning the formula — particularly the 40% bond component.

was gospel in the investment industry. Even though the 60/40 strategy has produced gains of 7% this year in the U.S., financial advisers say many pension-saver clients are abandoning the formula — particularly the 40% bond component.

U.S. Treasuries have lost about 3% this year, while benchmark 10-year bond yields have slid from a post-pandemic high of 1.77% to around 1.50%.

“The modern retiree can now expect to live a 30-year retirement and stocks have beaten bonds 98% of the time over this time frame,” said Sam Huszczo, founder of SGH Wealth Management in Lathrup Village, Michigan. “It is difficult to watch the stock market soar while 40% of your assets are simply inching along.”

(Source: Bloomberg)

Keep In Touch