Pre-Retirement Planning: Paving the Road Ahead

SGH Wealth Management

Though something that many don’t talk about, the first steps of retiring can be stressful. There will be a myriad of ultra-important decisions with only have one chance to get correct.

The first step in this process must be creating a written financial plan, proactively review and monitor. Did you know that only 33% of Americans have a written financial plan? For that 2/3rd out there that haven’t taken this step yet, it may be interesting to know that households with a financial plan are 2.5x more probable to save enough for retirement. (Source: Savology)

Many people who save money in traditional 401(k)s, Individual Retirement Accounts (IRAs) or other tax-deferred investment vehicles do so assuming their income-tax rate in retirement will be lower than that of their working years. However, it’s not unusual for retirees to find themselves in the same or an even higher tax bracket in retirement. How so? When you add up income from Social Security and required minimum distributions (RMDs), it may land you in an unexpectedly high tax bracket. Fortunately, several strategies can help reduce the effect of RMDs like Roth Conversions and Tax-Efficient Distribution Strategies.

Another important step is to know your Retirement Budget. Certainly not the most exciting part of retiring, but crucial all the same. Look at your current spending habits (fixed vs variable) to estimate your possible budget during retirement and reach out to gain access to our budget planning integrated technologies.

Other common topics to be ready for:

- The Pension Decision

- 401k Rollovers

- Social Security Income

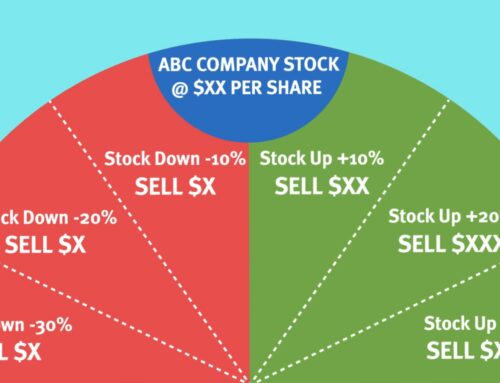

- Creating an Income from your Investments

- Health Insurance Planning

Keep In Touch