Will You be in a Higher Tax Bracket When You are 72?

SGH Wealth Management

Without your salary pushing into a higher tax bracket, it may seem like cheaper tax rates are in your retirement future but without long term tax planning it’s possible that your tax bill could get even worse in retirement. Here’s why:

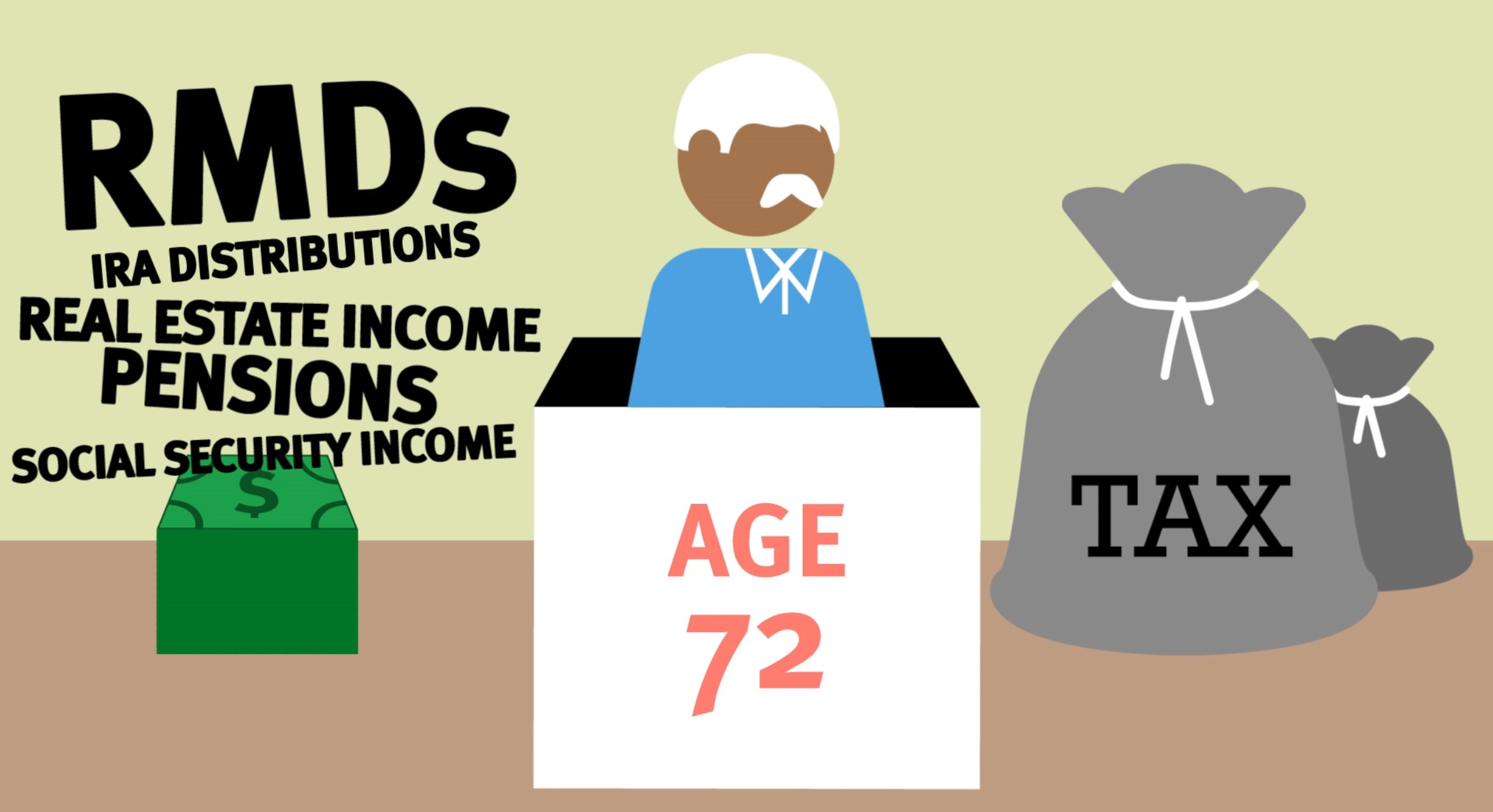

Multiple Income Streams

Multiple Income Streams

After working hard for 40+ years, you may have built up many different retirement income streams. For example, you may have a pension from a time at a large company, an annuity you were talked into by a commission salesman, an income stream from a real estate property, and your Social Security checks. All of these income streams combined can create a surprisingly large taxable income, even if each source individually doesn’t feel all that large.

Required Minimum Distributions (RMDs)

Required Minimum Distributions (RMDs)

At age 72, Required Minimum Distributions kick in on any tax deferred qualified accounts, such as traditional IRAs, 403(b)s, & 401(k)s. As the name says, an RMD alludes to a specified amount that you are required to withdraw as a taxable distribution each year, failure to do so could lead to a 50% tax… (yikes!) In addition this RMD amount rises each year, adding even more tax burden and pushing tax rates even higher.

The Future of Tax Rates

After WWII, the highest tax bracket rose to a whopping 94% in response to the US Debt-GDP ratio rising to over 120%. Today, the Debt-GDP ratio is over 135% and tax rates are lower in comparison. Seemingly unsustainable, history would imply that higher tax rates are in our future. A way to get ahead of these possible tax increases could be through advanced financial planning strategies like the Roth Conversion to lock in today’s low tax rates.

Keep In Touch